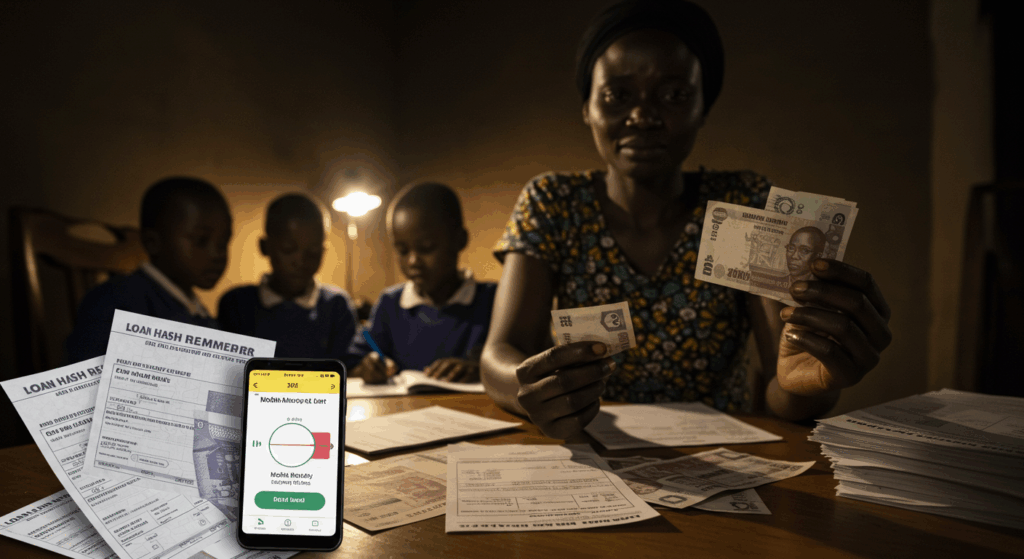

The Loan Trap is a harsh reality for most Ugandans, as revealed by a recent survey from Financial Sector Deepening Uganda (FSD Uganda). The study uncovered a shocking truth: seven out of every ten Ugandans spend more than they earn, meaning 70% of the population can’t make ends meet. This financial pressure forces them to depend on friends, family, and most notably, loans. For many, borrowing money isn’t a choice; it’s the only way to survive.

The Harsh Reality: Uganda’s Dependency on Loans

The 2023 FinScope survey by FSD Uganda painted a clear picture.The majority of Ugandans live beyond their means. Their expenses are higher than their income. This creates a big financial gap. To cover this gap, people turn to loans. They borrow from friends, family, and formal lenders. Unfortunately, this is not just a Ugandan problem. It is a widespread issue across Africa. Loans have become the new normal for daily survival. People use them for food, school fees, and transport. This cycle of debt is very difficult to break.

This dependency creates a vulnerable population. People are desperate for any financial help. They need money to keep their families afloat. This desperation makes them easy targets. They can be exploited by those who control the money. The story from Tororo is a perfect example of this exploitation. It shows what happens when hope meets a harsh system.

A Day of Hope and Despair in Tororo While Waiting for a Loan

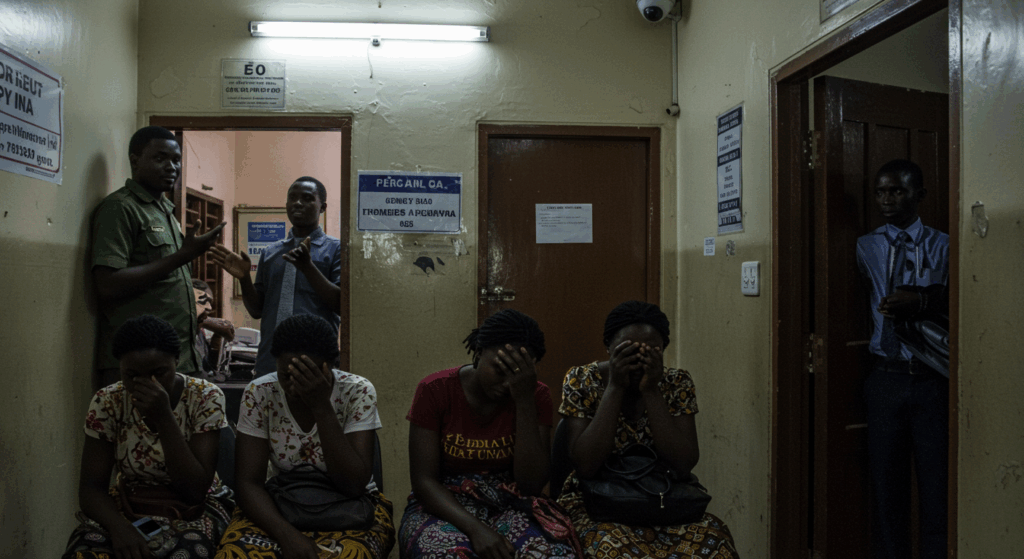

Recently, a sad event happened at a private lending company in Tororo District. Many people, mostly single mothers, had been promised loans. They had waited for two weeks. They arrived at the office as early as 8:00 AM, full of hope. They needed this money for their families’ welfare. The money finally arrived around 5:00 PM, guarded by strong-looking men. The waiting continued as names were called one by one. A camera in the corner recorded every transaction.

The women waited patiently for their turn. They saw three well-dressed ladies arrive late. Everyone assumed they were company staff. Finally, at 7:00 PM, came the devastating news. The money was finished. They were told to wait for another two weeks. The look of disappointment on their faces was heartbreaking. One lady had no transport money to return to her village. Her hope had turned into a financial burden.

The Corruption Factor: Bribes for Faster Service

The story gets worse.The three elegant ladies who arrived late were not company staff. They were also loan seekers. However, they had a secret advantage. They had given the loan officers and manager a bribe. This “something small” ensured their applications were processed first. They got the loans while the others got nothing. This is a clear case of corruption.

Imagine this situation. These women had to pay a bribe to get a loan. They will still have to pay back the full loan amount with high interest. This adds an extra, illegal cost to borrowing. It punishes the honest and rewards the corrupt. This act broke the trust of all the women who had waited all day. It showed that merit and need are not always important.

A Nation Surviving on Connections and Bribes

After the event,the women expressed their pain. They lamented the kind of Uganda they live in. It seems you need connections or a bribe to get services. This makes life very hard for the ordinary person. They wondered if this is how the whole country operates. Is Uganda a nation where who you know matters more than what you need?

While not every community is like this, the problem is common. Many people face similar challenges when dealing with officials. This culture of corruption destroys fairness. It makes the poor even poorer. It kills hope and encourages a system of patronage. Everyone suffers when trust in institutions is broken.So,what can be done to stop this? How can we empower people economically?